vivekkumar

New member

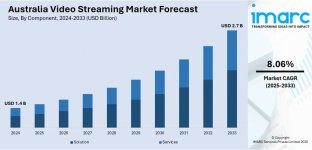

The latest report by IMARC Group, “Australia Video Streaming Market Report by Component (Solution, Services), Streaming Type (Live/Linear Video Streaming, Non-Linear Video Streaming), Revenue Model (Subscription, Transactional, Advertisement, Hybrid), End User (Personal, Commercial), and Region 2025-2033,” provides an in-depth analysis of the Australia video streaming market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia video streaming market size reached USD 1.4 Billion in 2024 and is projected to grow to USD 2.7 Billion by 2033, exhibiting a CAGR of 8.06% during the forecast period.

Report Attributes and Key Statistics:

- Base Year: 2024

- Forecast Years: 2025–2033

- Historical Years: 2019–2024

- Market Size in 2024: USD 1.4 Billion

- Market Forecast in 2033: USD 2.7 Billion

- Market Growth Rate 2025–2033: 8.06%

The Australia video streaming market is experiencing rapid growth as improved internet infrastructure and faster broadband rates are enabling more people to stream high-definition and ultra-high-definition content seamlessly. The country is seeing a surge in the adoption of smart gadgets, while streaming platforms are partnering with ISPs to deliver buffer-free viewing. Government initiatives are supporting infrastructure enhancement, further boosting market reach across urban and rural regions. Streaming services are currently optimizing their offerings to attract a wider subscriber base by providing personalized content, increased accessibility, and better device compatibility.

Request For Sample Report: https://www.imarcgroup.com/australia-video-streaming-market/requestsample

Australia Video Streaming Market Trends and Drivers:

Digital advertising is shaping the video streaming landscape in Australia as platforms continue to leverage data-driven personalization and innovative ad formats. Companies are adopting interactive commercials, skippable ads, and dynamic placements, which enhance viewer engagement. Partnerships between major streaming providers and content creators are resulting in a wider variety of exclusive offerings. The ongoing rollout of cloud-based and AI-powered content recommendation engines is promoting longer viewing durations. The market is also witnessing a rise in ad-supported, lower-cost, or free tiers, broadening audience reach and competitiveness.

Market players are capitalizing on rising internet penetration, supported by the increasing adoption of smart TVs, smartphones, and tablets. Enhanced broadband coverage is allowing users in remote and rural areas to access streaming content with minimal disruptions. Regulatory support and investments in telecommunications infrastructure are continuing to drive subscriber growth. The shift from traditional television to on-demand, multi-device consumption is underpinning sustained interest in video streaming services. Data analytics capabilities are enabling service providers to tailor content and ad experiences, driving higher user satisfaction.

Market Challenges and Opportunities:

Despite significant expansion, the market faces challenges such as fragmented infrastructure in remote areas and high data consumption costs. Intense competition among streaming providers creates pressure to consistently innovate and invest in exclusive content. There are also concerns over consumer data privacy, piracy, and cybersecurity. Some regions experience slower broadband speeds, limiting HD and UHD streaming quality. Regulatory hurdles and content distribution rights present additional complexity for market entrants and incumbents.

Rural connectivity upgrades and continued ISP competition are creating fresh subscriber opportunities. The adoption of immersive technologies—such as 4K streaming, VR, and AR—is offering new avenues to enhance user experiences. Growth in the commercial segment, especially content licensing for retail, hospitality, and education sectors, is driving market expansion. The increasing availability of hybrid revenue models attracts both premium subscribers and value-driven viewers, while partnerships with telecommunications providers help bundle and promote streaming services.

Australia Video Streaming Market Key Growth Drivers:

- Improved internet infrastructure and broadband speed.

- Increased smart device adoption and urban-rural connectivity.

- Rising digital ad spending and innovative advertising models.

- Ongoing shift to on-demand and multi-device content consumption.

- Regulatory and policy support for digital inclusion.

By Component:

- Solution (IPTV, Over-the-Top, Pay TV)

- Services (Consulting, Managed Services, Training and Support)

- Live/Linear Video Streaming

- Non-Linear Video Streaming

- Subscription

- Transactional

- Advertisement

- Hybrid

- Personal

- Commercial

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Regional Players:

- Binge

- Stan

- Foxtel Now

- Kayo Sports

- 9Now

- 7plus

- Fetch TV

- Netflix

- Amazon Prime Video

- Disney+

- Max

- Paramount+

- YouTube Premium

- Apple TV+

- Hayu

- BritBox

- Shudder

- Crunchyroll

- June 2025: Leading streaming platforms introduce AI-driven content personalization features, boosting average viewing times and subscriber retention.

- March 2025: Major ISP partnerships announced to offer discounted high-speed broadband bundles that include free ad-supported video streaming service access.

- Comprehensive segmentation and forecasting at country and region levels.

- Analysis of internet penetration growth, infrastructure development, and digital advertising trends.

- Detailed competitive profiling and company strategies.

- Insights into market challenges and emerging opportunities.

- Coverage of innovative technology adoption and government policy impacts.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24750&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1-201-971-6302