vivekkumar

Member

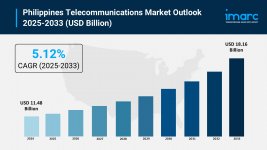

The latest report by IMARC Group, "Philippines Telecommunications Market Size, Share, Trends and Forecast by Component, Enterprise Size, Industry, and Region, 2025-2033," provides an in-depth analysis of the Philippines Telecommunications Market . The report also includes competitor and regional analysis, along with a breakdown of segments within the Philippines telecommunications industry . The Market size reached USD 11.48 Billion in 2024 and is projected to grow to USD 18.16 Billion by 2033, exhibiting a robust growth rate of 5.12% during the forecast period.

Report Attributes and Key Statistics:

- Base Year: 2024

- Forecast Years: 2025-2033

- Historical Years: 2019–2024

- Market Size in 2024: USD 11.48 Billion

- Market Forecast in 2033: USD 18.16 Billion

- Growth Rate (2025-2033): 5.12%

The Philippines Telecommunications Market is experiencing robust growth driven by expanding mobile connectivity, rising smartphone adoption with 86.98 million internet users achieving 73.6% penetration rate as of January 2024, and rapid 5G network deployment transforming digital infrastructure. Major operators are investing heavily in fiber-optic networks backed by World Bank funding of EUR 268.22 million for climate-resilient broadband connectivity. Technology integration including virtual reality, cloud gaming, and IoT solutions supported by government spectrum allocations positions telecommunications as critical infrastructure for digital transformation supporting e-commerce growth, remote work proliferation, and enterprise digital services expansion.

Request For Sample Report: https://www.imarcgroup.com/philippines-telecommunications-market/requestsample

Philippines Telecommunications Market Trends:

Philippines Telecommunications Market trends include 5G network expansion with nearly half of mobile connections expected utilizing 5G technology by 2030 representing a significant increase from just 6% in 2023. Globe Telecom expanded 5G coverage to 98.71% of Metro Manila and 97.97% of key cities in Visayas and Mindanao in Q1 2025 demonstrating aggressive infrastructure deployment. Technology innovations including online booking platforms, real-time availability tracking, and mobile app-based digital access control transforming customer experience. Advanced security features including enhanced cybersecurity solutions with AI-driven threat intelligence platforms differentiating providers in competitive urban markets. Fiber-optic infrastructure expansion gaining traction completing national backbone, extending middle-mile infrastructure to underserved regions, and developing last-mile connections addressing connectivity challenges. Partnerships between global tech providers and telecom companies reducing widespread adoption of advanced technologies reshaping broadband landscape reducing reliance on traditional DSL and wireless solutions.

Philippines Telecommunications Market Drivers:

Philippines Telecommunications Market drivers include mobile internet usage rising dramatically powered by affordable smartphones and competitively priced data packages catering to different income groups. Mobile-first behaviors boosting growth of fintech services, mobile apps, and digital payments relying on strong telecommunications infrastructure. Enterprise segment expansion with businesses increasingly adopting digital transformation requiring high-speed connectivity for video conferencing, remote work, and online education. Government support through Digital Infrastructure Project funding enhancing climate-resilient, secure, and inclusive broadband connectivity nationwide. infrastructure investments with PLDT allocating PHP 75-78 billion for 2025 network expansion covering fiber infrastructure and cell sites. Regional expansion beyond Metro Manila targeting growing economic hubs including Cebu, Davao, and Clark. Technology advancements including Google's Taara laser communication system providing a cost-effective alternative to traditional fiber-optic cable installation particularly for remote island communities.

Market Challenges:

• Infrastructure Limitations inadequate connectivity in rural areas with approximately 30% of rural communities lacking reliable internet access

• High Service Costs Philippines having the most expensive internet subscription rates in Southeast Asia limiting accessibility

• Network Quality Issues poor service reliability with frequent outages and slow average download and upload speeds compared to regional counterparts

• Limited Cell Tower Infrastructure only 23,000 combined cell sites nationally significantly lower than neighboring countries like Vietnam with 90,000

• Regulatory Compliance implementation challenges with new Konektadong Pinoy law requiring infrastructure sharing and removing legislative franchise requirements

• Competitive Pressure intense competition among service providers causing declining average revenue per user affecting profit margins

• Climate Resilience Requirements coastal infrastructure vulnerable to 20 typhoons annually requiring hardened shelters and elevated power plants adding 15-20% to rural site costs

• Digital Divide persistent connectivity gap between urban centers and underserved municipalities requiring substantial additional investment

Market Opportunities:

• 5G Technology Expansion deploying advanced applications including virtual reality, cloud gaming, and IoT solutions for tech-savvy consumers and businesses

• Fiber-Optic Network Development completing national backbone and extending middle-mile infrastructure to underserved regions with government funding support

• Enterprise Solutions targeting businesses requiring flexible digital transformation services including cloud computing, cybersecurity, and managed services

• Laser Communication Technology implementing Google Taara system providing cost-effective wireless optical connectivity avoiding expensive underwater cable installation

• Rural Market Penetration establishing infrastructure in geographically isolated and disadvantaged areas bridging digital divide with 60,000 additional cell towers needed by 2031

• Fintech Integration developing super-apps bundling payments, micro-loans, and entertainment under single login increasing average revenue per user

• Satellite Broadband Services leveraging Starlink and similar services covering remote areas complementing terrestrial infrastructure

• Infrastructure Sharing capitalizing on Konektadong Pinoy law enabling third-party access creating separate infrastructure businesses generating new revenue streams

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-telecommunications-market

Philippines Telecommunications Market Segmentation:

By Component:

- Hardware

- Broadcast Communication Equipment

- Telecoms Infrastructure Equipment

- Consumer Premise Equipment

- Software

- Platform On Premises

- Cloud

- Services

- Telecommunication Services

- Installation and Integration Services

- Repair and Maintenance Service

- Managed Services

- Small and Medium Enterprises

- Large Enterprises

- Retail and E-commerce

- IT and ITES

- Aerospace

- Healthcare and Pharmaceutical

- Media and Entertainment

- Hospitality

- Automotive and Manufacturing

- Transportation and Logistics

- Others

- Luzon

- Visayas

- Mindanao

June 2025: PLDT and Globe Telecom intensified 5G focus with PLDT allocating PHP 75-78 billion for 2025 investments in fiber infrastructure and cell sites, while both companies expanded infrastructure deployment demonstrating market maturation and commitment to network quality improvement supporting digital transformation across enterprise and consumer segments.

May 2025: Globe Telecom expanded 5G coverage to 98.71% of Metro Manila and 97.97% of key cities in Visayas and Mindanao in Q1 2025, rolling out 235 new 5G sites now supporting over 9.5 million 5G-enabled devices on network demonstrating aggressive expansion making next-generation connectivity more accessible across the Philippines.

April 2025: NOW Telecom lost mobile operator license by order of National Telecommunications Commission after failing to meet network rollout targets installing only six base stations out of 2,306 facilities committed, owing PHP 3.57 billion in unpaid regulatory fees consolidating market among major players PLDT, Globe Telecom, and DITO Telecommunity.

April 2025: Globe Telecom appointed new CEO Carl Raymond Cruz targeting growth in broadband and enterprise services units with ambition to become the Philippines' biggest telco by revenue within five years, planning GCash IPO in Q4 2025 or H1 2026 with expected valuation of at least USD 8 billion.

April 2025: PLDT completed acquisition of Digitel folding Sun Cellular into Smart Communications shoring up double-SIM users in low-end segment strengthening market position in increasingly competitive telecommunications sector with digital finance unit Maya contributing PHP 127 million to bottom line.

January 2025: Bases Conversion and Development Authority partnered with telecommunications infrastructure provider to deploy common towers across Bonifacio Global City, New Clark City, and Morong Discovery Park accelerating robust infrastructure development enhancing digital connectivity in strategic locations fostering innovation and technological advancement.

Key Highlights of the Report:

- Market analysis projecting growth from USD 11.48 billion (2024) to USD 18.16 billion (2033) with 5.12% CAGR

- 5G network expansion with nearly half of mobile connections expected to utilize 5G technology by 2030 up from 6% in 2023

- Mobile internet growth reaching 86.98 million users with 73.6% penetration rate as of January 2024 driven by affordable smartphones

- World Bank funding of EUR 268.22 million for digital infrastructure project enhancing climate-resilient broadband connectivity

- PLDT allocating PHP 75-78 billion for 2025 network expansion including fiber infrastructure and cell sites

- Globe Telecom expanding 5G coverage to 98.71% of Metro Manila and 97.97% of Visayas and Mindanao key cities

- Mobile data services dominating segment accounting for 53.11% of operator revenue in 2024 with continuous growth

- Luzon leading regional distribution with highest concentration of urban population and facility development

- Enterprise segment expanding with businesses adopting digital transformation requiring high-speed connectivity

- Technology innovations including Google Taara laser communication system providing cost-effective infrastructure alternative

Q1: What are the primary factors driving Philippines Telecommunications Market growth to USD 18.16 billion by 2033?

A1: Market driven by rapid 5G network expansion with nearly half of mobile connections expected to use 5G technology by 2030, increasing mobile internet usage reaching 86.98 million users with 73.6% penetration rate, and substantial infrastructure investments including World Bank funding of EUR 268.22 million for digital infrastructure projects. Government support through spectrum allocations and PLDT allocating PHP 75-78 billion for 2025 network expansion contribute to a steady 5.12% growth rate. Technology advancements including fiber-optic deployment, enterprise digital transformation, and fintech integration support market expansion.

Q2: How is 5G technology transforming the Philippine telecommunications landscape?

A2: 5G technology revolutionizing the market by enabling advanced applications like virtual reality, cloud gaming, and IoT solutions while significantly improving internet speeds and reducing latency. Globe Telecom expanded 5G coverage to 98.71% of Metro Manila and 97.97% of key cities in Visayas and Mindanao in Q1 2025, with telecommunications operators investing heavily in 5G infrastructure. Partnerships between global tech providers and telecom companies significantly driving widespread adoption. Government support including spectrum allocations fostering deployment and improving connectivity across sectors such as healthcare, education, and e-commerce positioning digital transformation and enhanced user experience as key competitive advantages.

Q3: What opportunities exist for telecommunications stakeholders in emerging Philippines market segments?

A3: Stakeholders can capitalize on fiber-optic network expansion completing national backbone and extending infrastructure to underserved regions, 5G technology deployment enabling advanced applications for tech-savvy consumers, and enterprise solutions targeting businesses requiring digital transformation services. Rural market penetration bridging digital divide with additional cell towers needed by 2031, laser communication technology providing cost-effective alternatives to traditional cables, and infrastructure sharing enabled by Konektadong Pinoy law represent opportunities. Fintech integration developing super-apps, satellite broadband services complementing terrestrial infrastructure, and cybersecurity solutions addressing growing enterprise demand support market growth diversification meeting increasing connectivity requirements across consumer, business, and government sectors.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=28754&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302