vivekkumar

Member

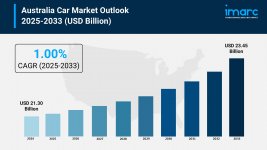

The latest report by IMARC Group, “Australia Car Market Size, Share, Trends and Forecast by Vehicle, Propulsion, Sales Channel, End Use and Region, 2025-2033,” provides an in-depth analysis of the Australia car market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australian car market size reached USD 21.30 billion in 2024 and is projected to grow to USD 23.45 billion by 2033, exhibiting a CAGR of 1.00% during the forecast period.

Report Attributes and Key Statistics:

- Base Year: 2024

- Forecast Years: 2025-2033

- Historical Years: 2019-2024

- Market Size in 2024: USD 21.30 Billion

- Market Forecast in 2033: USD 23.45 Billion

- Market Growth Rate (2025-2033): 1.00% CAGR

The Australian car market is witnessing consistent growth, with manufacturers introducing advanced electric vehicles (EVs), SUVs, and connected car technologies to meet evolving consumer preferences. Companies are growing their model ranges and investing in battery productivity, whereas government approaches are supporting the selection of eco-friendly vehicles through appropriations and infrastructure development. The market is benefiting from rising natural mindfulness, way-of-life changes, and technological development. As the charging framework develops and computerized highlights have become standard, both premium and reasonable brands are making EVs more open, reflecting a broader move toward supportability and smart mobility.

Request For Sample Report: https://www.imarcgroup.com/australia-car-market/requestsample

Australia Car Market Trends and Drivers:

The market is encountering a surge in demand for electric vehicles, backed by government motivating forces and the rollout of charging stations across the country. Customer preference for SUVs remains strong, with manufacturers offering a wide range of models, counting crossover and electric variants. Associated car technologies—such as real-time routes, in-car excitement, and AI-driven security features—are getting to be standard, driven by the tech-savvy populace and 5G arrangement development. Associations between automakers and innovation firms are quickening the integration of shrewd highlights, whereas independent driving advances are steadily entering the market, upgrading security and comfort.

Key drivers incorporate government approaches advancing EV appropriation, extending charging infrastructure, and rising buyer interest in maintainability. The developing ubiquity of SUVs, driven by their flexibility and common sense, is forming show portfolios. Mechanical progressions in AI, IoT, and vehicle networks are progressing the driving encounter and operational productivity. The showcase is additionally bolstered by lifestyle trends favoring open-air exercises and long-distance travel, as well as the expanding reasonableness of both extravagant and budget-friendly vehicles. The shift toward smart portability and digital integration is encouraging impelling market growth.

Market Challenges:

Australia's car market is grappling with several key obstacles:

- Decline in local manufacturing: The exit of major brands like Holden, Toyota, and Ford has eliminated domestic production, increasing reliance on imports.

- Global supply chain vulnerabilities: The COVID-19 pandemic and ongoing disruptions have led to delayed production and delivery of vehicles.

- Infrastructure constraints for EVs: Charging infrastructure remains limited in rural areas and regional regions, hindering electric vehicle (EV) adoption.

- Rising production and regulatory costs: Stricter environmental standards and emissions regulations force heavy investments in cleaner technologies.

- Economic headwinds: Inflation, interest rate pressures, and economic slowdown constrain consumer spending on vehicles.

- Skills shortages: The industry is short on specialists in EV tech, digital systems, and advanced manufacturing.

- Increasing competition: Domestic brands face stiff competition from global automakers offering more accessible and innovative vehicles.

Amid the challenges, several promising trends offer paths forward:

- Rise of EVs and hybrids: Government incentives, expanding charging infrastructure, and growing environmental awareness are fostering electric and hybrid vehicle adoption.

- Technological innovation: Advances like self-driving features, connected car systems, and AI-powered diagnostics enhance vehicle safety and appeal.

- Growth in SUVs and UTEs: Demand for versatile, rugged vehicles continues to rise, especially in regional and suburban markets.

- Used car and aftermarket expansion: Aging vehicle fleets and rising new-car prices are fueling aftermarket services, parts, and digital service platforms.

- Mobility services evolution: Ride-hailing, car-sharing, and mobility-as-a-service (MaaS) offer new business models beyond traditional ownership.

- Digital transformation and smart mobility: AI, predictive analytics, and fleet management tools are boosting efficiency and customer experience.

- Export and sustainability potential: Opportunities exist to tap export markets and adopt circular economy practices in vehicle and parts life cycles.

- Rising demand for electric and hybrid vehicles

- Expansion of charging infrastructure

- Strong consumer preference for SUVs

- Advancements in connected and autonomous car technologies

- Supportive government incentives and policies

- Growing environmental awareness and lifestyle changes

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on vehicle, propulsion, sales channel, and end use.

By Vehicle:

- Hatchback

- Sedan

- SUV

- Sports Car

- Others

- Gasoline

- Diesel

- Electric

- FCEV

- Peer-to-peer

- Franchised Dealer

- Independent Dealer

- Commercial

- Rideshare and Taxi Services

- Rental Car Services

- Corporate Fleet

- Individual

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

- Toyota

- Mazda

- Ford

- Kia

- Hyundai

- Mitsubishi

- MG

- Isuzu Ute

- GWM (Great Wall Motor)

- BMW

- Mercedes-Benz

- Tesla

- August 2025— Electric vehicle (EV) sales in Australia surged by 63% in Q2, with total EVs representing 9.3% of the national automotive market. Queensland led with an 80% rise in EV purchases, while Victoria followed with a 70% increase.

- August 2025— In response to accelerating EV adoption and declining fuel excise revenues, Australia is fast-tracking a national road user charging system. Trials using GPS telematics and hubodometers are underway, with plans for broader rollout beginning in New South Wales.

- July 2025— Tesla's brand momentum in Australia is facing a setback: its brand conversion rate dropped from 44% to 31%, while Chinese EV brands like BYD surged, capturing a 63% brand conversion rate, overtaking Tesla in popularity.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=32057&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302